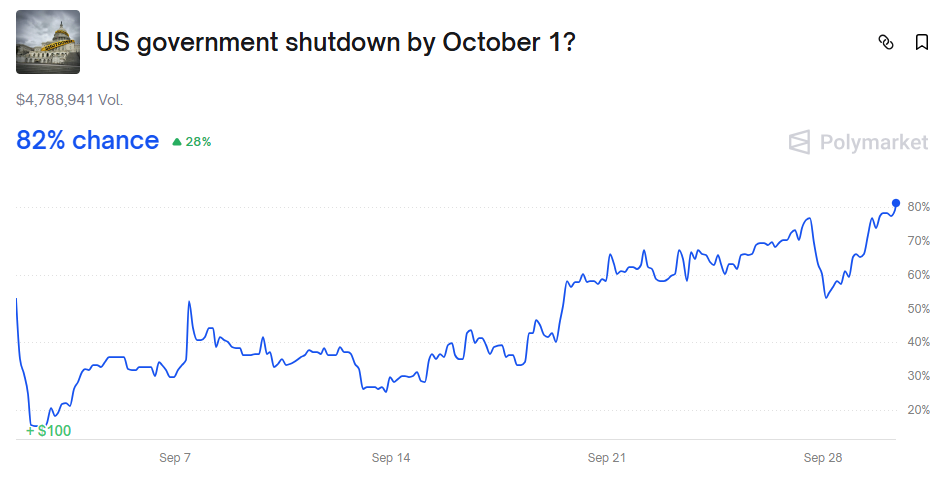

All right, so the odds are looking a bit elevated that the government might shut down. At this moment, betting markets are placing an 82% chance of the government shutting down:

And because of that, investors are a little bit worried about how that might affect the stock market. So let’s have a look. What does the data actually say?

And because of that, investors are a little bit worried about how that might affect the stock market. So let’s have a look. What does the data actually say?

When we look back at the history of US government shutdowns (since 1976), the S&P 500’s median return during these periods is a resounding 0.0%.

This return is calculated over the actual, brief duration of each shutdown (historically averaging around 8 days).

The political drama, while noisy, has historically resulted in no measurable median impact on the stock market while it’s occurring. The market might see a slight dip (often less than 1% to 2%) right at the start, driven by uncertainty, but this is often short-lived.

In the 12 months following a shutdown, the S&P 500 has overwhelmingly posted positive, often strong, returns. History suggests that a shutdown is a non-event for long-term investors. In the 12 months following past shutdowns, the S&P 500 has been higher approximately 86% of the time.

The bottom line: Political events create headlines, but your long-term financial plan should not be driven by them.

Standard Disclaimers:

Past performance is not indicative of future results. This information is for illustrative and informational purposes only and does not constitute investment advice or a solicitation to buy or sell any securities. All investments involve a degree of risk, including the possible loss of principal.